IRS Form 2290 is the tax form for the Heavy Vehicle Use Tax or HVUT. You must

file Form 2290 annually, for any vehicle weighing 55,000 lbs or more.

The renewal period or the due date for HVUT Form 2290 is typically from July 1 to August 31 each year. ExpressTruckTax has extended that renewal filing period by a whole month! Now our customers can e-file beginning June 1 until the deadline on August 31.

Visit https://www.expresstrucktax.com/efile/irs2290/ to learn more about Form 2290.

Visit https://www.expresstrucktax.com/irs2290/prefile to learn more about Form 2290 for 2023-2024.

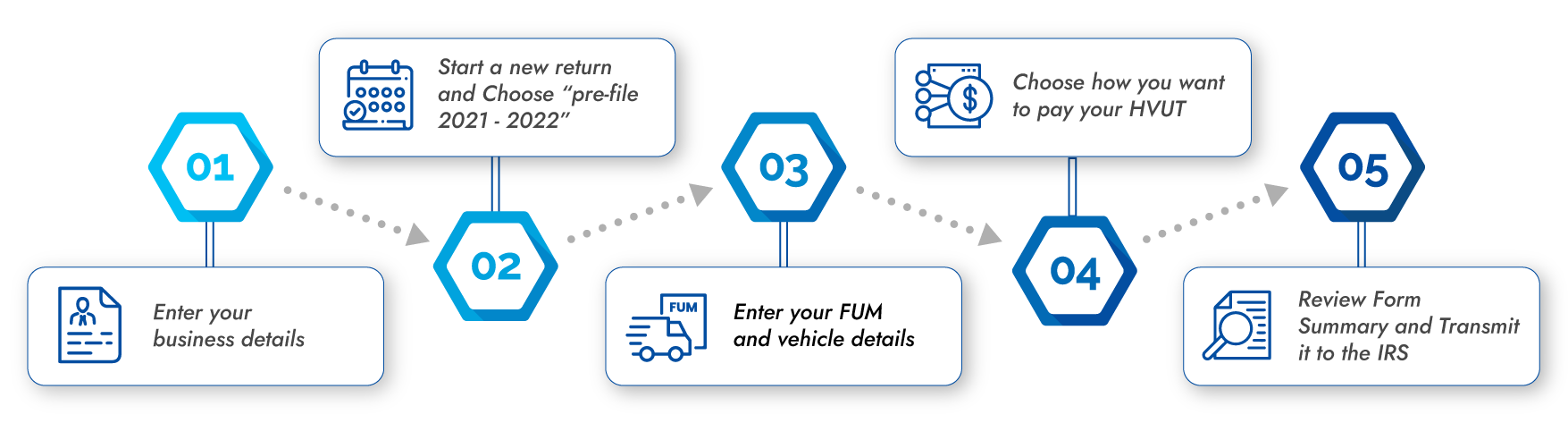

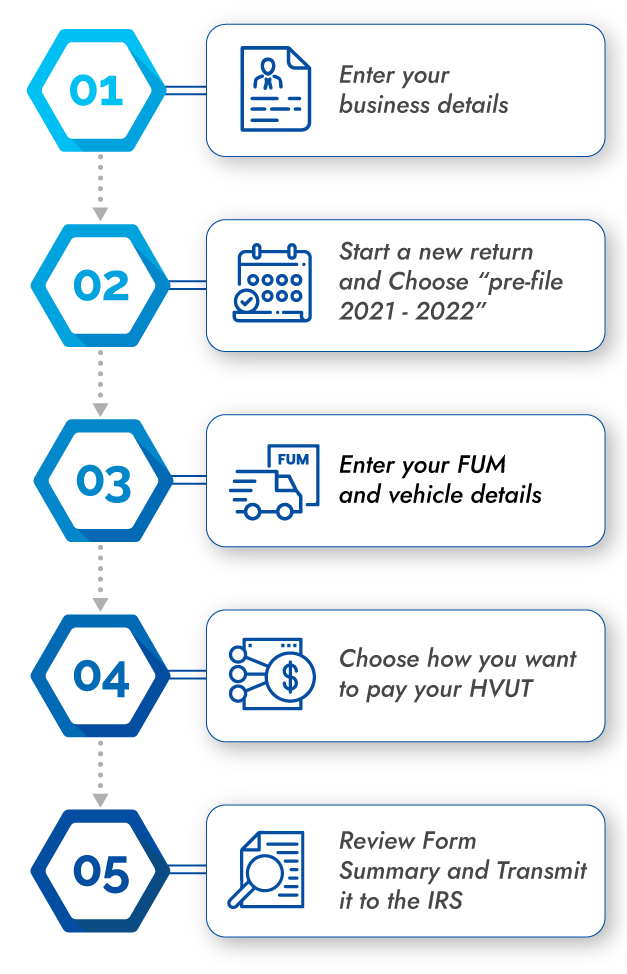

Pre-filing works the same way that e-filing does during the regular season. Instead of waiting until July to file, you can e-file now for the upcoming tax year beginning as early.

Filing in advance, doesn’t mean that you have to pay your HVUT! When you prefile 2290 you can find out how much HVUT you owe, and begin saving money, so that you are better prepared to pay it by the actual HVUT deadline i.e August 31.

It's the best of both worlds! You get filing out of the way but can continue to save up until your tax is due.

Get started with ExpressTruckTax, the marketing leading and IRS-authorized 2290 E-file provider to pre-file Form 2290 for the upcoming 2023-2024 tax year. Create a free account if you don't have an account, or simply sign in if you have an account already to begin with your filing.

We will transmit the returns for you once the IRS begins accepting Form 2290 for 2023-2024 tax Period on July 1, 2023. You will get the schedule 1 immediately by July 1, 2023 through your registered email.

With the ExpressTruckTax iOS and Android app, you can complete IRS Form 2290 and get your Stamped Schedule 1 instantly. E-file your Form 2290 from anywhere with your iOS or Android devices.

At ExpressTruckTax, we have a dedicated support team all year round that lives and breathes quality service. We are proud to provide the best customer support.

You can call us at 704.234.6005 from

8AM-6PM EST, Monday-Friday.

You can even chat with us on our website & we’ll walk you through the whole process.

E-mail us at support@express

trucktax.com for 24/7 support in English and Spanish.